Employee Fraud. It does not depend on the size, type, location or industry of the organization, as every organization is prone to this problem. We would like to believe that our employees are honest and trustworthy but still there are many reasons and ways in which your employees may become the part of fraud. A Report presented to the Nation on Occupational Fraud and Abuse (Copyright 2014 by the Association of Certified Fraud Examiners, Inc.) suggested that 5% of the annual revenue losses of the typical organization each year due to employee fraud. Therefore, prevention and detection is important to reduce the loss. Thus, every organization should develop a plan to prevent fraud is prior rather than after being affected from the loss.

There are many forms of fraud but the main three categories are:

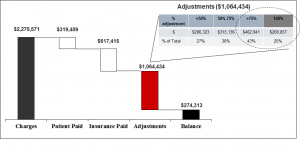

- Asset Misappropriation – This is least costly and made up 90% of all fraud cases. In this type of fraud, an employee either steals, exploits or misuse organization’s resources. Examples of asset misappropriation include fake reimbursement, stealing of non-cash possessions of the organization or cash before or after recording.

- Corruption – Corruption made up less than one-third of the total fraud cases and fell in the middle. Corruption happens when employees use the status or influence provided by the organization for their own benefit and violates the duty to the employer. Examples of Corruption include cases lie bribery, extortion, and conflict of interest.

- Financial statement fraud – This fraud type comprises of less than 5% of cases, but can cause median loss to the organization. In these kinds of frauds, employees intentionally misstate or omit the information in the financial reports of the company. This fraud may include fake revenues, hidden charges or liabilities or inflated assets.

Prevention

The presence of preventative measures, whether the organization is large or small, is vital. ACFE 2014 revealed that the fraudulent activities, which were studied to make the report, lasted an average of 18 months before they got detected. This shows that the loss is greater as the employee of your company are committing fraud for a year and a half. Therefore, there is a need to minimize the fraud occurrences by implementing adequate procedures and controls to prevent fraud.

- Know Your Employees – The first step to preventing the fraud is knowing the employees. Fraud perpetrators display the behavioral traits which indicate the intention of committing fraud. Potential fraud risks can be thus minimized by observing the actions and listening to employees issues. Management should build a trustworthy relationship with the employees and have time to know them. An attitude change can give you the clues and can suggest inter-organization issues that should be resolved immediately to prevent loss. For example, an employee may commit fraud to take revenge from the angry or dissatisfied boss. Or a hard working employee who has been serving your company more than a decade and is now, having personal and financial issues, could be an indication of potential fraud risk. It is important to know about your employees and have a good conversation with them.

- Make Employees Aware of fraud and its consequences – Employees of the organization should be aware of different types of fraud and its consequences to the organization as awareness is key to avoid big loss. And gives signal to the ones planning or thinking about to commit fraud. Also, the loyal and trustworthy employees who are the assets in preventing the fraud would have a enough knowledge about signs of frauds. According to the ACFE 2014 report, if there is a tip associated with report of fraud then they are easily detected (over 40%). The reporting system should be anonymous, and employees should be able to report fraudulent activity by keeping their identity safe.

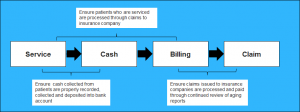

- Implementation of Internal Controls – To safeguard the firm’s assets and to ensure the integrity of its accounting records, implementation of internal controls is a must. Internal Controls include Segregation of duties to help reveal any discrepancies in the system. The other internal controls include documentation to help reduce fraud. The Internal controls should be monitored and regularly updated to ensure their effectiveness. An expert is needed to analyze the company’s policies and procedures to recommend the appropriate programs and implementations.

- Monitor Vacation Balances – If an employee has not missed a day of work in years, it could also be a sign that this particular employee has something to hide. It is also advisable to rotate the jobs of employees within the company. This may also reveal if there is any fraudulent activity going on as the second employee will review the operations of the first one.

- Hire Experts – Developing of anti-fraud policies can be helpful and these can be developed by hiring of professionals like CFEs (Certified Fraud Examiners) and CPAs (Certified Public Accountants). These experts provide services like internal audit and forensic analysis to extensive and primary consultations.

- Live the Corporate Culture – A constructive, positive and encouraging work environment can play a major role in preventing the employee theft and fraud. There should be clear policies and procedures along with a clear organizational structure. An open-door policy should be included to give employees the opportunity of communication and discussion with the top management and to prevent the fraud.

- Detection – With prevention strategies, the organization also needs detection methods to detect the frauds, and these procedures should be visible to the employees. The visibility of the preventive internal controls acts as one of the influential deterrents to fraudulent behavior. The fraud detection strategies need to monitor and get updated to ensure their effectiveness continuously. The plans take external information and then linked with internal data, the results are then used to enhance the prevention controls. The fraud detection strategies need to be documented along with the teams responsible for each task. Employees should be made aware of the implementation of the screening plan; this makes them mindful of the fact that company is watching and will take disciplinary action if the employees are found to be committing fraud.

Conclusion

Every organization is vulnerable to fraud and the employees who are intended to do fraud would not think about the size of the company. These frauds can cause massive financial losses, legal charges and affect reputation of the company.

Having a proper plan and strategy can reduce the losses. Therefore, to implement the preventive measures and to make the employees aware of the company policy can significantly reduce the activities from occurring as the cost of prevention is less as compared to potential fraud to be committed.