Best Practices in Financial Management for Medical Practices

Introduction

In today’s changing environment, a medical practice’s ability to ensure that revenue is maximized, and financial ‘leakage’ is minimized, is crucial to its economic success. Maximizing revenue includes ensuring the appropriate level of payments against claims for every patient serviced. Minimizing financial leakage is best achieved by implementing sufficient financial controls and oversight to ensure reconciled deposits across accounts and discouraging employee misconduct. While most medical practices assume they have implemented the appropriate level of financial controls, independent analysis typically reveals a surprising level of losses stemming from not having the right checks and balances in place throughout the Service-to-Payment process.

Service –to–Payment Cycle

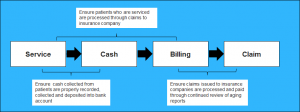

Figure 1 – Medical Practice Service-to-Payment Cycle – The service to payment cycle is the end-to-end process of servicing patients through to the receipt of payment for services renders from insurance companies. The optimization of this process results in an overall increase in profitability to medical practices. The process can be optimized through the monitoring of defined control points throughout the cycle.

The Service-to-Payment cycle is simply the end-to-end process of managing the receipt of revenues from services rendered to patients which includes:

Cash Payments Reconciliation – Practices which handle a significant amount of cash payments need to implement controls around the collection, recording, deposit, and reconciliation of funds. Cash payments offer significant opportunities for funds to be mishandled or for employee malfeasance. Best practices for handling cash payments include:Documenting each patient served through a sign-in sheet and recording the method of payment for service or co-pay.

- Documenting each patient served through a sign-in sheet and recording the method of payment for service or co-pay.

- Reconciling all payments collected by patients (Cash, Debit, Credit) against bank statements.

- Ensuring that all cash payments are totaled and reconciled daily with deposits at the bank. Cash payments should not be aggregated across multiple days to simplify reconciliation tracking for audit purposes.

Billing Assurance – Practices often miss filing insurance claims against all the patients serviced. In larger practices, a 1 or 2% rate of missed claims can result in a significant loss of revenue. These types of mistakes do not typically occur as a result of employee misconduct or malfeasance, but rather a natural error rate as a result of normal billing operations. Charge differential, defined as the difference between standard pricing and charges for procedures issued below the pricing negotiated with individual insurance companies, also impacts a practice’s profitability. This differential is typically difficult to monitor on an ongoing basis because it requires managing complex tables which track the billing agreements by current procedural terminology (CPT) code negotiated between the multitudes of insurance companies a practice interacts with.

Claims Assurance – Claims assurance is the management of claims from insurance companies to ensure that:

- All claims issued to insurance companies are paid.

- All paid claims are paid at the negotiated contract level with each Payer/Insurance company. This level is different for every Payer.

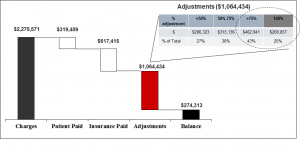

A critical area of claims assurance for medical practices is the analysis of adjustments on claims received from insurance companies. Adjustments should reflect a standard discount received against a claim from a given insurance company and should range from 20 to 50% based upon the CPT code. A thorough analysis will typically reveal adjustments in the range of 75% or above, with a 100% adjustment meaning the insurance company has not paid anything against the claim. Reasons for these high adjustments are multi-fold ranging from insurance company errors to rejection of claims due to input error from the practice’s billing staff. While this information is available in the standard billing software utilized by medical practices, the rigorous analysis of the aging report and the ability to mine the data into ‘useful information’ is what proves more difficult for practice personnel.

Figure 2 – Claims Assurance Analysis – In this sample analysis of insurance adjustments, basic information has been analyzed using the practice’s billing software. The $2.2M in revenue has been categorized into Patient Paid, Insurance Paid, Adjustments and Remaining Balance. The $1.1M in adjustments have been further detailed into groups of <50%, 50-75%, > 75%, and 100% adjusted. As can be seen from the table, the >75% and 100% adjustment buckets represent $732,798.

Rigorous Periodic Reporting and Analysis – Collectively, across the Service-to-Payment Cycle these shortcomings can add up to significant losses to practice ownership. How does a practice address the collective pitfalls across the cycle? Success is achieved through the thorough implementation of financial best practices across practice operations leading to effective management and corrective action. Best practices include:

- Periodic (daily, weekly, monthly) exception reporting across the Service-to-Payment cycle to quickly identify issues and prompt corrective action.

- Independent oversight of controls to minimize conflict of interest.

- Periodic analysis and tracking of key performance indicators to establish performance baselining and to ensure their long-term results are being achieved.

Conclusion

Particularly in today’s fast-changing environment, medical practices and facilities need to challenge themselves to take a fresh look at their operations. While office management may be reluctant to implement potential improvements, ownership clearly wants to increase operational efficiencies in order to mitigate the possibility of lost revenues. While these conflicting interests between vested parties often create a reluctance to take a fresh, objective review of the current processes, an independent analysis of operations can uncover and correct inefficiencies thereby increasing the practice’s profitability off of the existing patient base.

Leave a Reply

Want to join the discussion?Feel free to contribute!